It's not phenomenal for speculators to need to chase for quality stocks. All things considered, purchasing stocks when they're shabby stacks the chances of accomplishment to support us.

Be that as it may, the chase for quality stocks can get to be unsafe if financial specialists concentrate on shallow valuation measurements, similar to say, the cost to-income (P/E) proportion. I was helped to remember this by a late meeting my U.S. partner Rana Pritanjali had led with eminent valuation master, Teacher Aswath Damodaran.

Here's the specific trade in the meeting that set off my musings (accentuation is mine):

"Rana Pritanjali: What do you think financial specialists mean when they say that "This is a quality organization now"?

Aswath Damodaran: You know, what I hear is that they most likely found that the P/E proportion is under 10. Another part of the sluggishness that describes such a large amount of old fashioned quality contributing.

When I hear "esteem stock," what I as a rule hear is that you took a gander at the P/E proportion for the stock. It's lower than the normal, so you've chosen to call it a quality stock, or it has a major profit yield, in this way it's a worth stock. In the event that that is your meaning of a decent esteem, I believe you're in a bad position."

An incredible case of the peril that a visually impaired spotlight on shallow valuation measurements can bring is Swiber Property Constrained (SGX: BGK).

Swiber's PE proportion from 1 January 2012 to 31 December 2013

Source: S&P Worldwide Business sector Insight

You can find in the diagram above how Swiber's P/E proportion had just quickly broken 10 from the begin of 2012 to the end of 2013. Actually, the P/E proportion was bobbing somewhere around 6 and 8 more often than not. Thus, Swiber's P/E proportions in those two years were truly low.

For point of view, consider that (1) in the five years finished 31 December 2011, Swiber's P/E proportion had found the middle value of 13, and (2) the Straits Times File (SGX: ^STI), Singapore's business sector indicator, had a normal P/E of 16.9 from 1973 to 2010.

However, a speculator who purchased Swiber's shares anytime somewhere around 2012 and 2013 would sit on some ghastly misfortunes at this moment. The organization's offer cost had extended from S$1.57 to S$1.03 in that time span. Swiber's shares are at present suspended from exchanging, yet they were trading hands for just S$0.109 each only before the suspension. That speaks to a greatest loss of 93% from the costs seen in 2012-2013.

The organization's dazzling offer value decay following 2012 can to a great extent be clarified by its business execution. A benefit of S$0.202 per offer toward the begin of 2012 had turned into lost S$0.076 per share today.

A low P/E proportion can't benefit much if an organization's business would go ahead to perform ineffectively – Swiber is an extraordinary indication of this thought. Remember this in the event that you need to purchase esteem stocks.

Some extraordinary financial specialists –, for example, John Neff and Walter Schloss – like to purchase stocks with thrashed costs. That is on the grounds that they trust that a few stocks that have fallen hard might be a deal in respect to their real financial worth.

I occasionally run a channel to strainer at organizations with stock costs that are close to 52-week lows. On a side note, the utilization of stock channels can help financial specialists limit the playing field as opposed to experiencing the rundown of more than 700 organizations in Singapore's securities exchange one by one.

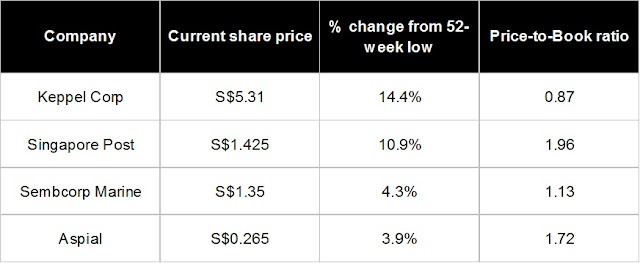

All in all, what does my 52-week low channel demonstrate this week? Here are a couple organizations picked indiscriminately from the rundown: Keppel Partnership Restricted (SGX: BN4), Sembcorp Marine Ltd (SGX: S51), Singapore Post Constrained (SGX: S08), and Aspial Company (SGX: A30).

Kepepl Corp, Singapore Post, Sembcorp Marine, Aspial, 52-week low table

Source: S&P Worldwide Business sector Insight

Keppel Corp and Sembcorp Marine are two understood organizations in the neighborhood market as both have sizeable business sector values; at their present offer costs, they have market tops of S$9.7 billion and S$2.8 billion, separately. That is by all account not the only similitude – they are a portion of the world's biggest developers of oil apparatuses and have overwhelming introduction to the oil and gas industry.

Given the sharp decrease in the cost of oil in the course of recent years, Keppel Corp and Sembcorp Marine both remarked in their most recent profit discharges that their organizations are confronting solid headwinds right now.

Singapore Post is another understood organization given the way that it runs Singapore's postal administrations. In any case, there's very to Singapore Post – it additionally has a retail shopping center (as of now under redesign) and gives logistics benefits that backing the eCommerce business.

The organization has delighted in solid income development (the top-line has dramatically increased in the course of the last five monetary years), however corporate administration issues that surfaced a year ago has weighed down on Singapore Post's stock cost.

Finally, we have Aspial. The organization has a wide range of organizations, including adornments retail, property advancement, and money related administrations.

A portion of the organization's adornments retail marks incorporate Aspial and Lee Hwa Gems. There are more. On the whole, Aspial has more than 70 gems boutiques in Singapore and Southeast Asia. The organization's property improvement business is centered around Singapore, Malaysia, and Australia. What's more, on budgetary administrations, Aspial gives pawnbroking administrations under its recorded auxiliary, Maxi-Money Monetary Administrations Corp Ltd (SGX: 5UF).

The following table shows how the quartet's benefits have changed in the course of the most recent 12 months and how their influence resembles (influence is measured with the net obligation to shareholder's value proportion and it is an intermediary for how much money related danger an organization is going up against).

Kepepl Corp, Singapore Post, Sembcorp Marine, Aspial EPS and NDE table

Source: S&P Worldwide Business sector Knowledge

It's significant that not each organization with a stock cost close to a 52-week low is a honest to goodness deal. A declining stock cost can decrease yet further if the fundamental business execution keeps on debilitating.

Nothing we've seen here about Keppel Corp, Sembcorp Marine, Singapore Post, and Aspial ought to be taken as the last word on their contributing benefits. The data displayed in this piece ought to be seen just as a helpful beginning stage for further research.

In the event that you'd like all the more contributing bits of knowledge and additionally the most recent news about Singapore's securities exchange, you can get both from The Diverse Dolt's free week by week contributing pamphlet, Take Stock Singapore. Composed by David Kuo, Take Stock Singapore can help you develop your riches in the years ahead.

No comments:

Post a Comment